Networth 2020, goals for 2021

December 24th, 2020 at 03:24 pmHi all

Writing to keep myself accountable.

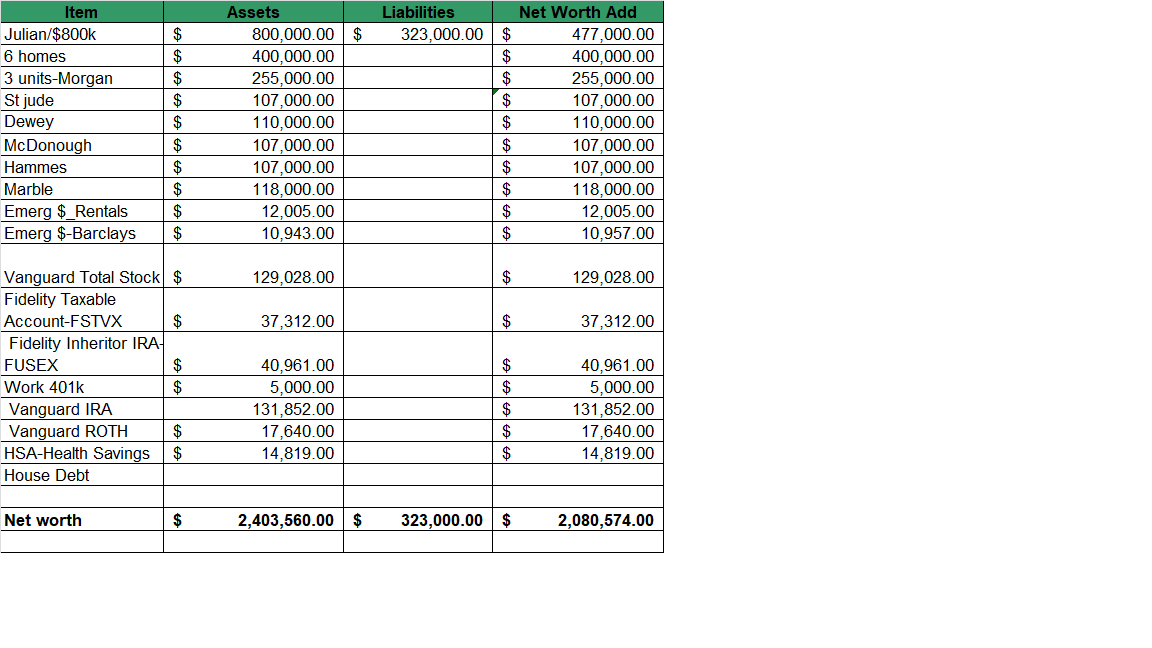

Current net worth for year attached

Next years goals

1. 500k total investments between taxable and tax deferred

2. fully fund IRAs for 2020/2021

3. Contribute max to regular or solo 401k (dependent on job)

3. Practice financial freedom. Fully live off rentals from Feb 2021. All earned monies go towards savings, giving or fun.

Towards this end I am looking at decreasing monthly costs first

1. health insurance is $540/mth (ouch, I am looking at how I can reduce this by $200, hopefully news next week)

2. cut costs of supplements $240 a year

3. cut lawn care costs by $200 a year

4. will cut HSA fees by 100 a year (did not know it was that high) by moving it to Fidelity

5. will cut monthly chiro membership, will save over $600/yr

6. will look into reducing cable boxes and using Roku and Infinity add on to still get Comcast on those TVs for free (potential savings, $180 year)

7. will look at eating out costs

* I increase my auto investments amount by the amount of the cut once it is made and official

and then rental income

1. will look at rental variable costs (utilities, taxes, and maintenance). see if we can do better

2. will look at vacancy rates, see if we can do better

and my income

1. line up a contract for after January (preferably 1099 for tax advantages)

2. look into other income sources to switch too or just to have. (ideas wholesaling real estate, blog, consulting or selling something in my own business)

and not losing track of the big picture

1. Make an impact on people. Share my faith and blessings with others.

2. Make a bucket list of items I want to buy or do or help people with and work my way through it.

PS For those who are struggling or get discouraged. I just looked back at my first entry, October 2013, I had just bought the first 6 homes and was recovering from basically losing everything. It really is very emotional to read this and think back. I was so full of excitement, fear and hope back then and so naive but I hung in there and I MADE IT. You can too.

This was a quote from my very first post

" I am concentrating on real estate as my avenue to freedom.. looking at 'monthly income' vs savings. I want to have enough monthly income in 5 years (see my goals) to feel 'safe' and like I have choices. I am in good shape and health so do not feel I will quit working but will certainly enjoy any job I do more knowing I do not 'have to' work. "