|

|

|

Viewing the 'Musings' Category

August 1st, 2023 at 02:48 pm

Hi all. I am back. It has been almost 2 years. I quit work at my high stress job 6/16. I was in severe burnout when I quit. I just took 4 weeks to visit my Ma and national parks.. from Sequoia to Seguaro to Yellowstone/Grand Tetons and all the ones on the way out and back from Chicago area... also Smokey Mountains. I am getting my national park passport book filled up. I just got back from my trip last week so settling in and figuring out what I want to do. Health coaching comes to mind or working at the church or an active job. I will investigate all. I am relying on the rentals fully this month and set up an automatic draft on the 1st from the rental account to my main account of $5000. My budgetted costs shoudl be around $4700 but I lived a lot looser when I was working and also I compensated for my stress and lack of time with going out to eat ALOT. I will track my actuals these next 3 months to get a handle on things. Rentals tracked over $9k a month in 2021, dropped to $7500/month in 2022 (due to messy evictions caused by the eviction moratorium and also city inspections started in Joliet and it felt like the guys wanted to make up for not doing inspections for almost 2 years. I got tagged with new windows for two of my buildings (the entire building!) and a sewer job). This year we look to be averaging around $8500/month. Now that I am off work, it feels good to have less stress, more free time and to eat healthier foods and to try out new things again. I did not realize how much of my life was 'on hold or deferred' due to work. Since my last post in 2021 I have enlarged my emergency fund to almost 11 months of expenses, enlarged the rental emergency fund and bought and paid off 2 new cars. I signed up for Motley Fool and will use that to help me invest the money i save(anyone doing that?). I am also using this time off to catch up on medical appts.. all preventative checks ..and so far all is great. I am 52 now (wow.. time goes by). I used to save alot. the 'house remodel' took a lot of TIME and savings.. luckily the house value is still holding but I have not saved large sums (to invest) probably since 2020. I have set a goal of $2k a month starting in this month. In 2015 I saved $73k.. Wow. Last year I paid off 2 cars.. a 2018 Lincoln MKZ and 2018 Chevy Suburban so definately keeping the saving muscle exercised... years before that I was paying off the house remodel. ANyway. a bunch of random thoughts right now. I will figure out what I am doing and aiming for and post here to keep myself accountable.. sortof like an online diary. VERY interested in learning how people are saving costs or doing things on the cheap now that I have time to investigate that. I will read that 'alaska plane ticket'post carefully. About 2 years ago I was seized by the idea that life is short and want to really live and enjoy life while I can. I read that 'Die with Zero' book and HIGHLY recommend it to everyone here. It really changed my perspective. It says most people die with 40-75% of their money left over.. and it recommends we want make a time bucket list vs a bucket list.. the time bucket list concept puts age and health status in there. So when we form our bucket list of things we want to do or experience we take into account health (ie CAN we do it still).. ie taking a world trip at 70 may not be possible or as fun at that age.. water skiiing, skiing, hiking etc. I am building my list and will share it here. Also thinking of a camper van for road trips next year.. anyone here have one? the market for them is coming down and now with my roadtrip experience (taking in someone else's camper van) i can see the value. Looking forward to reading al your posts and cheering each other on.

Posted in

Musings

|

6 Comments »

October 24th, 2021 at 09:38 pm

Hi guys

I am at $535k right now with investments. Goal is hit $1mm by Oct 2024. Alot depends on the market and my savings rate. I will hit $560k by year end just with contributions. Hitttig $1MM, unless I hit a real good stock, is dependent on a high savings rate.i am going into more mid caps lately.

I just turned 51.. I am feeling like I am entering phase 2 of my life and want to move and do somethign else and more so be 'coupled'.. not fun to plan for the future single. I am dating but have not found 'the one'.yet. I hang on to those who are 'not the one' too long.

How much money is enough?

I have $535k an investments that I do not need to touch and approx $9k a month coming in from the rentals. Monthly budget is approx $4700. I will try to reduce that even further but I also have 600+k in the house in terms of equity. if I were to sell I could easily buy something else somewhere else for less.. and have no mortgage and maybe money left over from the sale and more money each month on top of it

I think I hang on partly due to fear, partly due to a 'purpose'and partly because I feel stalled in planning.

I may be subject to the vaccine mandate and may lose my job.. not known yet so am just working and saving everything I can. I live fuly off the rentals and save/invest 70% of what I make between the rentals and my w2 income

We may have to evict 2 people.. they lifted the eviction moratorium .. the 2 homes where that may occur I may sell and reinvest in a different house or 2 flat that I feel is more solid and more desiraable. This may cut cash flow short term but I think may the better long term move

Hope everyone is doing well. These were just some random thoughts.

I really like goals and they motivate me. Being stalled in terms of goals brings me down

Rachael

Posted in

Musings

|

1 Comments »

September 9th, 2021 at 02:33 pm

Hi guys

Some random items...

I hit $500k. This is a big milestone for me by the way. So many years had gone by where for the most part most of my money went into the rentals. I still have a job and am funded thru 2023 but am unclear the impact of covid restrictions on that.. and also not sure if I want to work that long at least there. Also have my trusty Suburban which will outlast me. I am striving to hit over $550k for the year. I would like to hit $750k in savings before I stop so I am working hard to hit big savings milestones each month. I turn 51 next month. I will not touch any money until at least age 62. I am wondering if I can stop workign so hard and relax some on the big savings milestones each month. I am also single so if I get married again (which I want to do) my obligations will decrease.

I am working on getting my financial coaching blog up next week to s build that income stream too.

Rentals continue to do well with the majority of rents reliably showing up by the 9th.

I am deferrng buying more rentals until the prices come down (after the foreclosure waivers expire) and likely in the Fall/Winter.

I had my own house appraised for sale and rental rate. Rental looks like $5000 and sale almost $1MM.. really shocking but the comps and other homes sales near by show it. I have options if I want to move which would be to sell and buy something for less or rent my house for a year or two to gather more appreciation then sell at a higher profit. My mortgage is only $2350 so if I can get rent at $5000.. even taking out 5% and a few hundred for costs (which are less likely as the house is almost new) I can expected to net over $2000 (which should pay for somewhere else) and decrease the mortgage by over $600 a month. I wonder sometimes about a housing crash as it has gone up so fast this past year or two

Have a great day everyone. Just recording to look back at later.

Posted in

Musings

|

1 Comments »

August 26th, 2021 at 07:35 pm

Hi guys.I am $7,000 away from being at $500k investments!!! Took a long time coming as I put so much towards the rentals. the rentals are paying off though. Average monthly for the year NET is $9800. I have not been hit by any major costs though. so no roofs or big window jobs. I will want to save up for those. I am up $3000/month on the average more than with the old property mgr even though his rate was 5% of rents and the new guy is 6.5% of rents. BIG difference. I hardly think of the rentals now when before (as some of you know) it was an ongoing nightmare

Work is going well.. asked for and got a raise of $4/hr which is $8k a year if I stay. I also get overtime at time and a half which is very lucrative. I will work until at least end of year I think then go from there.

I want to switch my investments around

What do folks recommend for taxable and tax deferred accounts that I do not expect to draw from for 10 year or more?

My goal is to reach $550k investments by year end.

I DO want to buy a 2 flat or something but am waiting for nearer to year end as folks start to drop prices.

I am putting in most of my money into investments and would like to get to #750k-$1mm before I stop saving but dont want to wait years to do so.. my plan is still in flux. Thinking of diverting some funds to individual stocks vs safer S and P 500 mutual funds.

My house is still doing well and the area I live in is doing great. hopign prices continue to go up so I can sell, take this money and buy somewhere lower cost w no mortgage or very small.

Thoughts on investing welcomed.

Rachael

Posted in

Musings

|

4 Comments »

July 5th, 2021 at 05:02 pm

Hi everyone.

That job that I thought was so awesome was not. They switched my reporting structure between the interview and first day and I was 'semi' reporting to a micromanaging sortof toxic lady. Those who have read my blog for a while remember the last time that happened. Anyway. after lots of stress and indecision I decided life was too short and I quit after a week. Turns out my contract company knew this lady (she once worked for them) and totally understood. Anyway they found me a contract at that first higher paying company.. and I started May 10 (asked for a late start). I work at a very large energy company and make $14 more than I made before at my last job at that bank.. that is a $28k per year raise if I stay a year. This company also has no term limits so in theory I do well, and I have gotten lots of good feedback so far, then I can stay forever. They even brought up last week about me coming on time (do not think I want too right now). I also get time and a half for overtime and basically my norm is50 hours a week since I am in the midwest and everyone else is on the East Coast. I normally start at 6:30 for early east coast calls and run til 4:30.. I LOVE the job. love the people and have gotten lots of good feedback. Really a God send. never had such a great start to a job. Anyway I am back.. and want to clarify with myself about ‘financial freedom’.

I have been tracking my rentals since Jan (new property manager) and my average Net is $9300 a month. This does not include possible income taxes. I talk to my accountant tomorrow on that. His original forecast was $1500 taxes a month if I do not have a job.

My monthly expenses are $4700..

I have only worked for 8 weeks so far so have been catching up on the real estate escrow (for the rentals, $40k) etc. I did not self-escrow last year as I was paying off house debt from the house fixup.

I just signed up for the 401k though and will put 100% of my salary in that for the next 6 weeks and after I escrow the rest of my real estate taxes (also next month). I will be in the position to save over $10k+ a month. I currently save $1500 a month. I currently have $450k of investments and my goal this year is to get to $550k and overall to get to $750k. $550k may be a stretch for this year but we shall see.

I am starting to really see the fruits of my labor during the ‘paying off 6 homes in 5 years’ era.

I am seeing someone and it can turn into marriage. He wants too. I am unsure but I DO know I want to get married and it is a very fun idea to find someone to do things with, road trips, walks, exploring and enjoy life with trips and family/ friends.

I have been reading about people who retire early and their concerns and struggles and one guy I read clarify my fear. I do not have a ‘cash fund’ for large extras…. like a car or whatever. My plan is to save $25k into such a fund just keep it at Barclays or somewhere (recommendations ) for each access. This will be in addition to my 3 month emergency fund. I am really adverse to debt.

My house continues to do well. I live in Naperville and we were hit by that tornado. I was not but not 5 minutes away homes were destroyed or heavily damaged. Naperville is in the middle of a big growth spurt. Lots of building.. homes and retail.. lots of people moving out here from Chicago. My house should appreciate nicely and give me enough to buy a house for cash somewhere else. They are building 1.1 MM (starting price) townhomes like a block away. I do want to move either South or North West. I am SO GRATEFUL I finished my house before Covid hit

I am going to be looking at my investments.. (currently all in either target funds w vanguard or S and P total market vanguard funds) to see if I want to re-allocate. Also looking the Motley Fool stock advisor. Any one try that?

Have a good day everyone. I am OFF today.

Posted in

Musings

|

3 Comments »

March 15th, 2021 at 07:20 pm

HI all. I am on my first day of work. So far so good. They are having me shadow someone for a week or two so will not know for sure until I am on my own. Looks like it is well within my capacity (actually lower responsibility then normal). Hoping the stress level is less and thinking it will be. Also restarted school for a Master in Spiritual Formation and Discipleship. Excited about that. Rents continue to come in and I do not plan to work long if it takes me away from what I want to start (blog etc). My purpose of this job will be to save money. All money goes to savings or extras or give away or classes. I am eligible for the 401k) no match of May 1. As of that time I will put in 80% and continue living off the rentals for the rest. My goal is to have $550k in savings by year end and fully fund the 401k and IRA. Is it too late to contribute to the 2020 IRA? I will ask my accountant. So far two months totally living off the rentals.

I am drafting up my personal finance blog and hope to that up and started within 2 weeks.

I went to Florida and Tennessee on my break and loved both. Still thinking of moving from Illinois.

It was really neat not having to work and having less pressure these past several weeks. I do not ever want to go back to the life I had.

I have a 2008 suburban LTZ and thinking of gettign a newer used car.. still figuring if I want a large SUV (similar to what I have) or a mid size.. (Hyundai Palisade). sortof logical or want. I do not want something that feels old or will rust or have issues. 2020 Palisade Limited 15k miles (approx $40k), 2016 GMC Yukon XL Denali (approx 41k). Mine should sell for approx 10k. already have some interest.

We shall see..

Rachael

Posted in

Musings

|

4 Comments »

February 21st, 2021 at 06:18 pm

Hi guys. I got a job.. this is a another contract.. no term limit. .. pays $4 more than my last job. total raise $8000 a year. Capped at 40 hours a week and their entire IT department outsourced so I am managing the vendors who are doing the projects. Managing vendors has always seemed to be lower stress than being in charge of the project and ultimately responsible for the outcome and also handling those last minute issues. problems, deadlines. Now the vendors can do that. I can set expectations, follow up, help them handle problems if needed but otherwise they do the work. I guess if you work more than 40 hours for some reason you take time off the next week to balance it. the $10 increase job by the way disappeared and went out to government bid. They expect the rate to drastically decrease

FINGERS CROSSED the job I got is lower stress like I am thinking.

I took this job in part because I thought it was lower stress and in part to get the job search monkey off my back. Also it is with one of the largest staffing firms so if things do not work out they can move me (if I stay on good terms which I will). I can MAX out the 401k here too. My prior job limited me to only 3% of my salary. No match here but as I just turned 50 I can put in $26k and another $7k to the IRA. Huge. I will save outside of that too.

On another front I am moving full force into my blog set up, will buy a wholesaling course tomorrow and may resume class at Moodys (zoom). I have made contact w the church and will join a small group and talk to someone next week about how I can help the church.

I start March 15. I want to clarify all of the above other activities in these next 3 weeks so I can go into this new job with a routine and boundaries and can 'timeblock' this job up front (time to workout, time to go to class if I do that and the foundations of the blog etc set up). My eventual plan is to switch off into one of those.

This job has an office building downtown but is currently work at home. My recruiter does not see downtown Chicago returning to work until next year and I was upfront to her that I am not returning to work downtown Chicago or really at all. She says if/when it becomes an issues we will figure it out then and maybe switch me or maybe I will move or quit. LOTS of people are moving out of Illinois and really I would not mind moving. My work (IT program mgmt) is more and more remote so I can get a job at Chicago rates maybe and live in the South.

Anyway regardless of what happens I do not want to to go back to an all encompassing job or bad situation so if for some crazy reason this turns into that I will leave.

This month was my first month living off the rentals.. everything else was saved. SO GLAD I switched management companies. The increase is monthly percentage I pay them is more than paid with the increased rent collection, decreased costs and lower stress and time.

Rachael

Posted in

Musings

|

6 Comments »

February 12th, 2021 at 07:25 pm

Hi there. Quick update here. I did more research and asked more questons and that $10/hr increase job is definately what I want. I am NOT in charge, assisting on one large project for the entire time. not multiple... 40 hour cap... just sounds so much less stressful. The other job is handling multiple projects and part of a high performing team. Anyway.. it turns out they want a 2nd interview on the $10 hr job. It will be set up Monday. The person I interviewed w was the program manager.. and he was told he could pick but apparently when he ran it by him the upper mgr , upper mgmt wanted to talk to me as well. No word yet if they are calling in more than 1 person for 2nd interviews. I also have 2nd interview on the $2 increase job Tuesday.. If the first job comes through I will likely cancel that.

I so hoped to be 'one and done' but to meet upper mgmt is reasonable . I wish I did not want the job so much as it makes me nervous. Do not put the cart before the horse!!

Onward!

Rachael

Posted in

Musings

|

3 Comments »

February 11th, 2021 at 03:04 pm

Hi all.

Job search update. I was set up for 3 interviews. One I did not like and subsequently did not get the job. The other two look very positive. I may get an offer today at $10 more an hour than what I made which is $20k more a year. the other one has a second interview next week and I am the top candidate... there are 2 spots and 3 people called back. That jobs pays $2 more than I was making per hour. The $10/hr job appears to be a project manager (vs program manager) where I am not the boss (hopefully?) and if that is the case may be less stress. The $2/hr job appears to be a high energy fast moving team.. may be stressful.. everyone is very engaged with everyone else and on to deadlines. so much so the onsite person who works for the same contract company was not even able to meet w me at all.. the $10/hr job is a big huge program but I am not the program manager and will be working w this guy that I seem to ahve a good repoire with... and in contrast to the other company he was able to do an almost 90 minute laid back interview.. so hard to tell on interviews.

I feel GOOD and validated that I got good feedback and did well on the job interviews and it appears I may get two offers... one at an incredible raise.

On the other hand I am hesitant about going back to work right away. I guess I thought the job search process would take longer.. or that I would not open myself up to interviews right away.

The company these are through (contract company) is the same one I would go thru to return to my old job in 3 months so I want to remain on good terms to keep that option open

Some of my random thoughts. diary form.

I DO want to save up an additional $150k+. I want to do that Quickly not over years. I need income to do that.

I also want to increase my rental emergency fund quickly to $20k. . I need income to do that.

I DO find myself hesitant to spend larger sums as I have no 'job income'.. and the pay off will be longer. I do not have 'sinking funds' for the items I want to buy.. ie blog start up costs, wholesaling course and costs up front... these are only a few thousand (lets call it $5k) so I can come up with it and pay it off at 0%. Rentals appear to pay for all costs and I also should get unemployment of $3200 a month,.

My rentals have remained solid and look to stay that way. Wow what a change.

I DO NOT want my life to be turned over to a job.. no free time, stressed, not working out.. no life.,.

I really DO NOt care if I am in charge at work.

I DO want to work at the church or some sort of discipleship. I have a call w the church this week on this.

I DO NOT want to 'offend' or get on bad terms w this contract company. I am concerned suddenly bowing out of a job without a reason may reflect poorly on me

A friend of mine suggested exploring the companies/opportunities more (how flexible it is, stressful, can I timebox it, easy to take vacation etc) and then figure out what I really want in detail .. at a highlevel it is income and flexibility. see if these jobs can do that or at least do it MORE than my last job to allow me time to accumulate some money quickly and still take vacations and build on the side the other stuff I want to do and gradually pick that up maybe vs a total stop of job income and than start something new. I was not able to multitask well w my last job. Part of why my last job was so stressful was I allowed it to be that way (big part maybe?) and I was in charge. I also did not really take vacations or plan balance in my life as I was so focused on paying off that house debt. Items for sure I want are vacations and ability to fit in working out and flexibility for appts or whatever else... CALMNESS Based on that maybe accept one of them or reject both if I feel I can not do what I want. I am only 50.. most people are working in something. I did not plan to quit work and sit at home. My thought was to find something else and eventually do very well. I am wondering if I can find a low stress job to do while I work on the other stuff.

I have been off work for a week and basically have just relaxed and thought about things..and enjoyed.. I have not made significant progress on church, blog or wholesaling.

I will work on getting clear with what I really want to today and a question list for those jobs. If I get it I expect to hear by noon. It is 9am here now. It is amazing how sometimes the pay is not commersurate with the stress level.. (if I am correct it appears the $2 hr raise would be more stressful then the $10/hr )

Going to work out!

Rachael

Posted in

Musings

|

1 Comments »

February 4th, 2021 at 05:28 pm

Hi everyone. I am caught between apprehension and JOY.. I rolled off my contract.. no job.. free time.. lots of thinking.

Contract ended Friday.I left on good terms so can go back in 3 months. Also have 2 job interviews lined up this week Friday. Not sure if I want to go back right away though. I want to see 'how it feels' to be off and rely on the rentals and get to know me and what is out there again. Interviews range from $2 to $10 more per hour per job ($4000 to $20000 increase per year). I am so blessed I got into the field I am in... seems like rates just keep going up. All are work at home. As you recall my goal was to increase my investments over $100 k this year. I need a job to do that.

I am currently saving $850 a month. I will increase that with rental overage and when I get a job or other income.

Signed up for unemployment.. $505 + $300 .. so $805 a week.. that is a LOT! I thought it was in the 400's.

True to my word.. I will only pay my bills from the rentals and all the above will go towards savings, investments, fun or costs as well as any rental overage. I am starting 'sinking' funds for windows on two of my rental properties ($$)

Rentals are 100% full. This new manager is AMAZING!!! my stress level is way down with the homes. I feel more in control.

Today was cost savings/ look at money day . I was in the Obamacare Bronze plan $550/mth. I switched to an offmarket plan for a $200 savings, set up an auto pay to fund my IRA for this year and cut cable by $40.. every little bit helps. I have some rugs etc to sell to clear out house and other stuff to give away. Now that I am at home I want to get a handle on my eating.. less eating out (not as healthy! and I feel less energetic), Also moved my HSA to Fidelity which is no cost. $100 saving a year.

I was looking and my real large cost is this crazy big house. taxes are over $12k a year. so that means over $1000 of my monthly mortgage is taxes.. I will sell this at some point but the building and development here is out of this world so figuring to stay a few years to cash in on any price appreciation

I have a 2008 chevy suburban with 176k miles. still looks good.. runs like a champ .. new engine at 125k.. a newer suburban would be nice but want to wait and see on gas prices and the getting a newer one and the associated huge cost does not seem exciting to me right now. I am still thinking mine will sell for $10k.

I am starting a financial blog and getting into wholesaling. Steps for the blog are 1. get pictures, 2. contract to build the site and structure 3. start!!

Wholesaling. steps.. .investigate courses.. looking at Alex Martinez or Blair Halver course, buy one, learn and act.

Onward. Hope everyone is doing well out there. Keep moving forward.

Rachael

Posted in

Musings

|

3 Comments »

January 21st, 2021 at 03:46 pm

Hi everyone.

Quick question. We all talk about networth on here.. and many of us have a very good networth. Much of my networth is tied up in income producing real estate and comparatively less in cash investments. I feel 'less secure' with this model and am focusing now on quickly beefing up my investment/savings side. My goal is $750k. but if I set this goal I feel I am stepping back on the treadmill that I want so much to get off of.

Do other people feel the same?

What amount in savings/investments makes people feel financially secure.

I know it is technically related to how much our expected costs are, life expectancy. .but I am wondering if people on here struggle even when those appear to be covered?.. those who have used the FIRECALC and come up with no lines ending in zero.

How do you make that emotional decision that you are 'ok'?

I am rolling off my contract here 1/29 with no job lined up and honestly I want to take some time off and feel excited but also apprehensive to do so.

Maybe not such a quick question but I welcome thoughts and opinions.

Rachael

Posted in

Musings

|

5 Comments »

December 24th, 2020 at 03:24 pm

Hi all

Writing to keep myself accountable.

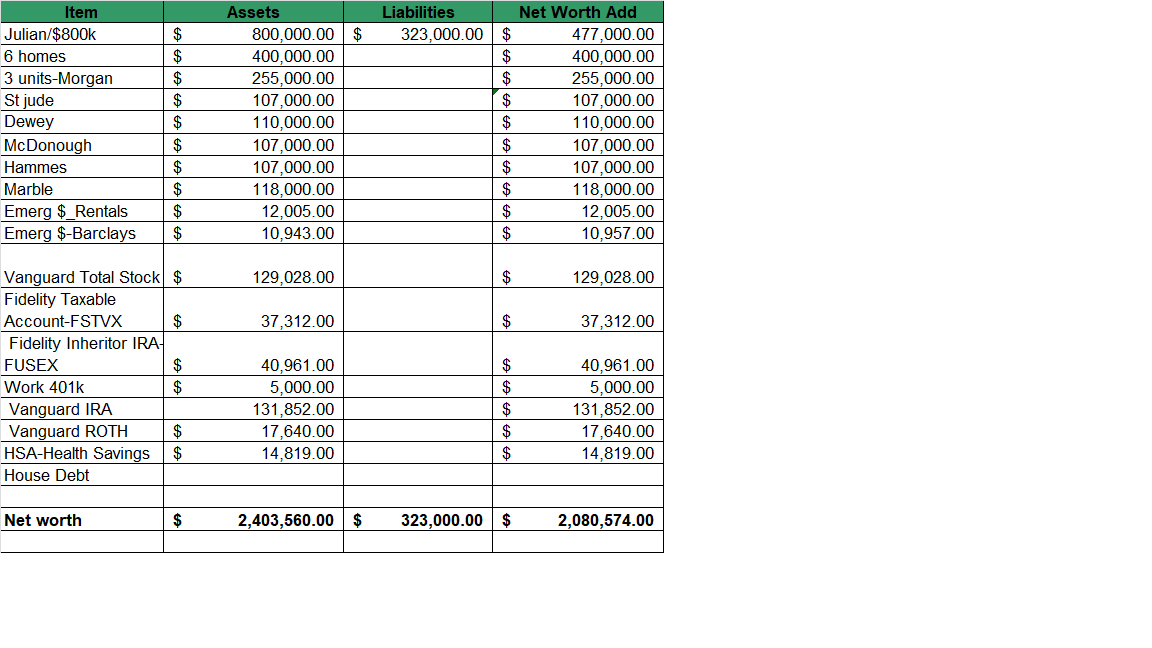

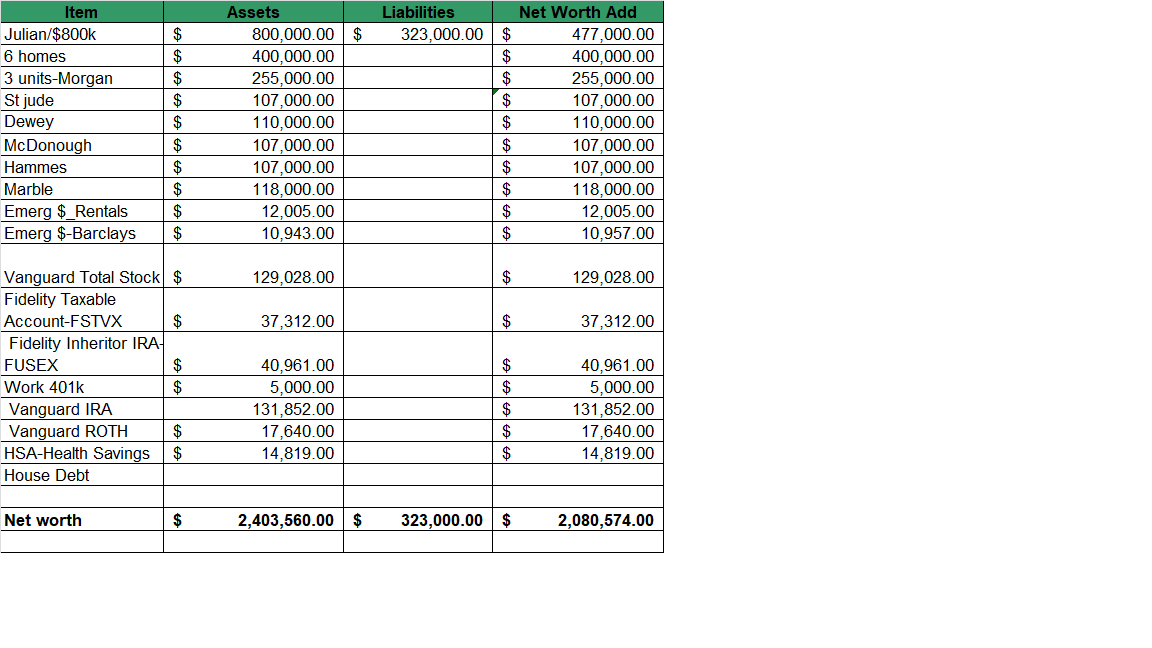

Current net worth for year attached

Next years goals

1. 500k total investments between taxable and tax deferred

2. fully fund IRAs for 2020/2021

3. Contribute max to regular or solo 401k (dependent on job)

3. Practice financial freedom. Fully live off rentals from Feb 2021. All earned monies go towards savings, giving or fun.

Towards this end I am looking at decreasing monthly costs first

1. health insurance is $540/mth (ouch, I am looking at how I can reduce this by $200, hopefully news next week)

2. cut costs of supplements $240 a year

3. cut lawn care costs by $200 a year

4. will cut HSA fees by 100 a year (did not know it was that high) by moving it to Fidelity

5. will cut monthly chiro membership, will save over $600/yr

6. will look into reducing cable boxes and using Roku and Infinity add on to still get Comcast on those TVs for free (potential savings, $180 year)

7. will look at eating out costs

* I increase my auto investments amount by the amount of the cut once it is made and official

and then rental income

1. will look at rental variable costs (utilities, taxes, and maintenance). see if we can do better

2. will look at vacancy rates, see if we can do better

and my income

1. line up a contract for after January (preferably 1099 for tax advantages)

2. look into other income sources to switch too or just to have. (ideas wholesaling real estate, blog, consulting or selling something in my own business)

and not losing track of the big picture

1. Make an impact on people. Share my faith and blessings with others.

2. Make a bucket list of items I want to buy or do or help people with and work my way through it.

PS For those who are struggling or get discouraged. I just looked back at my first entry, October 2013, I had just bought the first 6 homes and was recovering from basically losing everything. It really is very emotional to read this and think back. I was so full of excitement, fear and hope back then and so naive but I hung in there and I MADE IT. You can too.

This was a quote from my very first post

" I am concentrating on real estate as my avenue to freedom.. looking at 'monthly income' vs savings. I want to have enough monthly income in 5 years (see my goals) to feel 'safe' and like I have choices. I am in good shape and health so do not feel I will quit working but will certainly enjoy any job I do more knowing I do not 'have to' work. "

Posted in

Net worth,

Musings

|

5 Comments »

December 22nd, 2020 at 05:24 pm

HI all

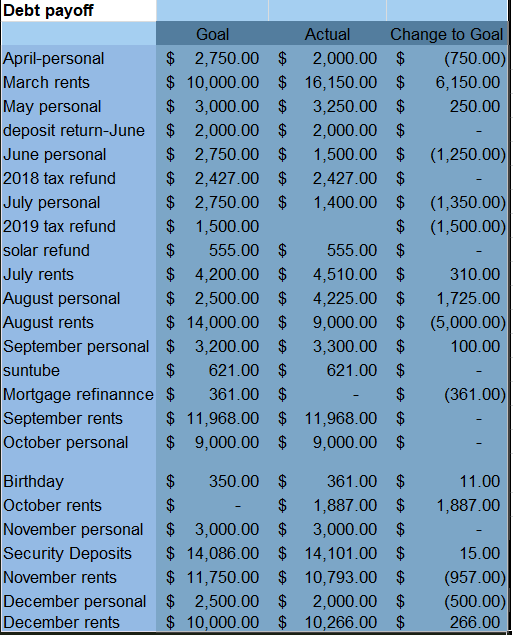

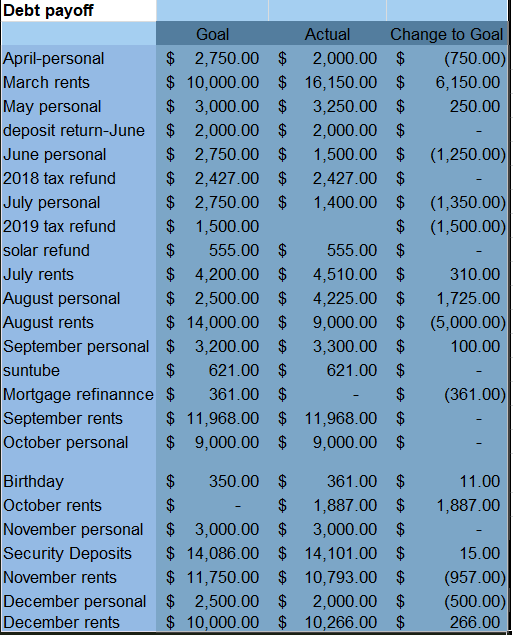

Above is my house fix up debt payoff. goals to actuals. I am so grateful for this group. I am looking forward to setting goals and investing more. My past 6 years most of my money (though not all) went towards the rentals and this crazy house fix up. I DID continue investing automatically every month through out but not as much. Still figuring my goals but here are some updates.

1 I paid off ALL the house fix up debt and I did not have to sell any properties to do so. Crazy insane year. Finally that house fix up period is over and I now have an almost brand new house that will I think appreciate quite a bit in the next 2 years.. if the new tear downs and builds mean anything. I think I will keep the house at least 2 years to take advantage of that. We shall see.

2. My contract at work ends 1/31/21. I have 3 potential job opportunities winding their way through the process. I do not expect much news until after the near year. I DO plan to go back to work at least for a few months to build up my savings (see my new sidebar). The job market is slower for sure but still a few things out there.

3. After January 2021 I will transition to FULLY relying on the rentals for all my regular costs and budgetted extras so anything I make in a job will go towards savings/investments minus some fun things and helping people. I want to use my money on experiences and helping people vs buying things.

4. I think I feel safer having $750k in investments to feel financially free (so I am $370k short right now) but I do not want to fall into the trap of continually movnig the goal posts for myself. I will reevaluate that as I go. I am already starting to relax a little bit with money. I have taken several small and midsized road trips this year and am loosening up on spending. I go to North Carolina skiing and hiking next week. I do not want to waste money though so I try to be frugal where I can and still live a bit. I awnt to give away more too. I somehow came up with $100k (see graphic.. note I did not escrow for real estates taxes last year so the months skipped of rental monies or super low rental monies reflect those monies going for taxes) between April and now to pay off the house fix up debt. if I can do that again it can really help this goal of $750k but how much of my life do I want to give up for that.. not alot. so it will depend on this new contract. One job I interviewed for sounds SUPER awesome and fun (and pays the most) .. the others sounds average.. not as exciting or fun. we will see. (and pay less).

5. I feel grateful to still have great health and a car that is nowhere near it's end .I love my chevy Suburban!

6. I will evaluate this year if my new property manager is savings me money or costs slightly more for more peace of mind. In either case I am beyond thrilled with switching and the peace of mind it brings.

7. I want to lower my house costs and move eventually. I do not see this house as a long term house.

Keep going forward everyone. Momentum is key. Even doing one thing towards your goals a day or week keeps you on track.

I am teaching a David Ramsey financial freedom course next month via Zoom. I will get it set up on the web and post it here in case anyone wants to come.

The Christmas Star was here!!

Posted in

Musings

|

2 Comments »

November 13th, 2020 at 07:26 pm

Hi everyone,

I keep trying to update my settings and it does not work. Where can I get help? Rachael

This is the error. Line 13 is the blog description. I did not try to change that but when I got this error I deleted the description and it still gave me an error.I did not try to modify the header.

ou have an error in your SQL syntax; check the manual that corresponds to your MariaDB server version for the right syntax to use near ' journaldesc = '', ...' at line 13

Warning: Cannot modify header information - headers already sent by (output started at /home/savingad/public_html/header.inc.php:1) in /home/savingad/public_html/blogs/cp/settings.php on line 149

Posted in

Musings

|

1 Comments »

June 22nd, 2020 at 08:34 pm

Hi there. An update here.

I have officially finished the house. What a long strange trip it has been. I essentially broke even on the fix up which is a HUGE achievement considering all the issues I encountered. So no net worth change basically since late 2019. I took out $150k from my taxable investments for the downpayment on the house and then some fixup.. I now 'have that money' in the house. It is preferable to have it OUT of the house and in investments but it is what it is.

Sales price is $850-900k per 3 realtors. worst case net $800k,

It occurred (and is occurring to me) to sell it and move to a lower cost house with a very low mortgage or no mortgage but I am just so exhausted from moving and 'fixing up' homes that I am sortof done (for now).. At least I know I have the option to do that. The area I am is pretty stable so I should have that option in the future too. The idea of having a paid off home is very attractive. The house I have now is gigantic for me and essentially brand new.. better suited for a growing family.. I often think of the opportunity cost of staying and wonder if it is worth it.

I will refinance the house in the fall to lower my payment by $3-400 a month.

I owe $316k on the house and $93k house fix up. I plan to pay off my real estate taxes and then defer all rental profits to the payoff until done. Target if the job extends is to pay the 'house fix up' off in February.

My contract likely ends mid December. I am on track to still have 30k left to pay off at that time. I am on a high priority project so may be extended but this company has a mandatory 23 months and you are out (for 3 months) policy.

I want to basically stop working January.. or take a break. so tired of my job. I really dislike sitting at a desk or doing desk work.. and very high stress.. sortof burned out.. This particular job though allows me to stop and then come back in 3 months if I want.. So I am figuring I will stop, not work, test my courage in relying on the rentals and doing my own thing, draw unemployment for 3 months or so..not sure.. I can always go back to this job or some other.

I want to continue to save lots though so the high dollars are attractive. I would do better in a more active job even if in the same role..or I can do something else. I will take those few months or from now til December to figure it out

From now to December I also want to tighten up my budgets, figure out what I spend on, tighten up the rentals.. etc

On a HIGH surprising (in a good way) note. the rentals have held firm through the virus and riots. no real missed rents.. The only impact which is huge is that the management company suspended showing and renting properties from March to June 15. I have 3 vacancies.. 2 homes and 1 1 bedroom. Hoping to fill them soon. Lots of money lost.

Lots more to share. and have goals to set. I see a lot of long timers are getting 100% out of debt lately. very impressive.

II want to turn away from 'work'.. the crazy house fix up project and start doing 'life' more. I just moved in to the house slightly over 2 weeks ago and the stress is starting to dissipate and I feel energized.

Hope all is well with everyone in this crazy chaotic year.

Posted in

6 homes-rentals,

3 units-rentals,

Musings

|

3 Comments »

December 23rd, 2019 at 06:12 pm

Hi all

Quick update. I am back and need to get serious here. I have wasted a lot of time on this new house and $$. I have lost track or site of my goal. My goal was to pay off all those homes and then feel free to leave my current job which pays well and CHOOSE to do something else that may or may not pay as much but offered flexibility and much more satisfaction and meaning. I paid off all those homes and then lost site of my goal with this new house. I bought what was going to be a lower cost home and do some fix up to it. The 'fix up' became exponentially larger because of code changes, restrictions, feasiblity and then the house sustained major water damage in the middle of the project.

Facts

1. house fix up was to be $210k. I am still tracking costs.. so have no final figures but will get an estimate shortly.. it is likely to come in over that but not by much which is an achievement

2. amount from insurance company to fix water damage $156k and I will be asking for more.

3. I am currently staying in a rental house (paid by insurance) while my house is being completed

4. target completion 4/1/2020

5. I am watching costs and fix up work and the house is very likely to appraise at or more than what I paid for it (including the fix up costs)

I will detail our more later. .jsut making a commitment to get back on track here and goal is to pay off house debt in 6 months..

I need to set MUCH more detailed goals and will do so,.

Rough plan to pay off house fix up debt (currently $175k and should not rise too much more if at all) is to take the rentals money each month (average $8k/month) and put that towards it and then sell one of my 2 flats.

More updates later.

Rachael

Posted in

Musings

|

2 Comments »

March 6th, 2019 at 12:37 pm

Hi all

Today I paid off my last property... the infamous '2 flat'

Work still going well. rentals still going well .. I am now waiting to make a decision on the 2nd floor work on my house.

Once that is done I will revise my budget to see if I can get that paid off within a year.

yesterday was the anniversary of Dad's death.. feeling slightly melancholy, sad, sortof like I need to change my life and life is short.. do more of what I want to do..

Have a great day everyone

I DO feel good I made this last milestone and am upping my deposit into investments while I figure things out.

Rachael

It would be easier if it was not SO COLD. I get tired after being cold all day and struggle to be productive or do much after work a I am workig out in the am now, trying to get to work earlier and do some physical activity after work to counter that.

Posted in

6 homes-rentals,

3 units-rentals,

Musings

|

6 Comments »

February 28th, 2019 at 01:15 am

Hi all

I have been away awhile here.

LOTS happened since we last talked.

I went to Israel!! wow.. incredible amazing trip. There is SO MUCH archaeological support for what is in the Bible.

I bought a house in Downtown Naperville. 2300+ square feet.. $433k.. $182/sq foot. Average square foot cost is $240 but going up to $400/sq foot across my side of downtown over the past 2 years.. got a real good deal I think.. my house was the 2nd lowest in 2 years outside of a tear down

I did the following to the house and just got permits completed TODAY

Full repipe, upgraded electric, regraded yard (owner had 4 feet of dirt piled around the house with landscape stone retaining wall), drain tiles, new kitchen, remodeled basement and 1st floor full baths, repaint, refinish floors etc

I WAS going to extend the dormer roofs but that is a little complex (older home, newer codes, higher cost than you would think to retrofit) and really there is no way to make the 2ndfloor look as nice as the first floor so I am investigating removing the 2nd floor and building a new full height second story going out to the outside walls.

Rough bids were between $135 and $175k.I have drawings and am obtaining detailed bids from 3 firms. My goal is around $135k or LESS and I think I can do that.. I can bring my own contractors for some trades and will do so for HVAC, electric, plumbing and windows.. all of which worked on the 1st floor and give me contractor rates.

The 2nd floor will add 600 more square feet.

I got $153k from the sale of the old house and have $70k of that left. I will make the rest up with income from me or rentals. and short term line of credit (already open if necessary). I do not want to OWE anything of the remodeling after a year. I pulled $100k out of investments to put down on the new house.

I have a NEW job.. LOVE it.. pays well. in Naperville.. great.. awesome.. 18 month + contract.. low stress.. large bank.. program manager. I can wear jeans to work!

Here is my net worth now. You will see it did not go up that much as I am spending a lot on the house and will not show or realize any value add until it is done.

House is 6 blocks from the train and real nice sought after area so expect to get my money back w this rehab if done cost effectively but I am involving realtors and other advisers to keep costs in check and make sure the value is there for the work I am doing

Networth below.

I am RELIABLY pulling $7-8k out of the rentals a month for the past 3 months!!!

Posted in

3 units-rentals,

Musings

|

5 Comments »

September 13th, 2018 at 12:36 pm

HI all

This is more a journal entry.. My friend Lisa died suddenly this week. She was 59, had a heart attack Sunday PM, CPR for 40 minutes, went to the ICU. They cooled her down so her brain could 'recover'. It apparently never did or was too damaged. She had a 2nd heart attack, never woke up, they removed life support and died yesterday. Very sad. She was one of those people who was the light of the room. Makes you realize how short life is or can be and we never know when our time is. Reminds me of a quote from a movie .. goes something like this "Remember this moment this moment is your life" and 'don't waste my time I am dying"

Anyway.. I will help coordinate services and hope to speak but up to the kids who I do not know well (they always lived out of state. never met)

Anyway it is time to set NEW GOALS. Those who know me know I set a 5 year goal just about 5 years ago. I met and exceeded that goal. financially at least. I did not really set 'non financial goals'. This time around I want to set financial and non financial goals. I will use this group and others as sounding boards. I will change my headline too. Current headline is '5 years to freedom'. I am thinking I achieved monetary freedom but do not feel comfortable using it and really I just paid taxes this month so want to 'test it'.

Currently thinking to include the following categories: financial, health, personal relationship, family, spiritual, career too. We will see how it breaks down when I actually set them.I will set 5 year goals at a high level then break them down to maybe 3-6 months.. easier to achieve and see progress

I have gotten a lot of support, feedback and motivation from this group and for that I am grateful

oh.I GOT APPROVED FOR THE LOAN and can hold both my current and new house short term!! Unless something major happens.. (the house not selling at all ever??) my new house is a GO. Israel.. Sept 28-Oct 12.. Close on new house Oct 17.I will hold both for 2 months (hopefully through mid Dec to allow for fix up) and then move in. Holding both loans is NET less then moving stuff into storage and finding someplace to live and less stressful.

Excited to set new goals.

Rachael

Posted in

Musings

|

5 Comments »

September 8th, 2018 at 03:27 pm

Hi all

Lookings like I can list the 2 flat around $134900.. sell between $125-130. I owe $11800 on it.

These are the #s (attached)

It will need a new roof at some point and it was a nightmare to fix up. I do not think I want it anymore and would prefer to invest the cash.

Below is my rental budget WITHOUT the 2 flat. With the 2 flat it goes up approx $1000

Posted in

6 homes-rentals,

3 units-rentals,

Musings

|

6 Comments »

September 3rd, 2018 at 05:00 pm

Hi all

Some updates over the past few months. overall things are up and down.. still stressful.

1. Work. I am still at that company that wants me to work downtown. Since my last post they have been saying. "we will just work downtown through June", then thru July, then August and now it appears never ending. I am required to be onsite Tues-Wed and stay overnight. I really dislike 'traveling every week, packing up, staying over, working late'. I was only passively looking but I did apply for and interview somewhere else. I did really well but did not get the job. My Israel trip is Sept 28 so will stop really looking until after that. Company hired 12 other full timers since last post and I am the only contractor. I continue to have nothing to do, no official role, and feel my job is not stable and is at risk. The word is that the company is going back to the full timer model (vs contractor). I did switch to W2 so I could maybe find another house

2. I signed a contract on a house.. $433k. My house is expected to sell around $530k and is on the market as of Saturday. Close date Oct 17. I should find out this week if I can hold both homes at the same time (short term). The new house is in downtown Naperville (which I prefer better than my outside of downtown subdivision). It is older and needs some work but is selling at a price point of $182/sq foot. Average is $238/sw foot and based on my estimates and quotes I can raise the value easily to $238 or more like $250k. the improvements I have in mind are likely to bring it to $600k+ based on comps.

I am nervous about this house as I do not have the loan locked down yet (expect approval Tuesday though) and those who have read me a while knwo that my last loan attempt fell through at the last minute. I have until Sept 25 to secure loan approval and expect news Tuesday. If I can not hold both loans for a short while I may be in trouble trying to sell fast enough to do a dual close and may back out of the contract.

Really need prayers.

The reason I signed a contract on a house was because I really do not want to live here anymore, I have nothing in common w anyone, for some reason I live by all sorts of dogs who bark all the time and I want to lower my monthly payment and get unstuck. I have wanted to sell and move for a while.. a LOOONG while but never got the courage up and homes were too expensive. To find a $433k house in the heart of downtown Naperville with almost 2500 sq feet, large kitchen, good floor plan,basement w high ceilings that can be finished, and large rooms is an amazing find. AND the ability to get my money out immediately if need be.

I did not sign up for school as I can not really concentrate on school w the work situation and will be out of town part of the quarter w Israel.

I will likely restart school after the new year.

Rentals. I am thinking of sellign that new 2 flat. I will talk to realtors and my property manager Tuesday. I should net $100k

I pay all taxes today. This is my last big milestone. I have not really pulled much from the rentals as I have been 'catching up' on the tax escrow.

I put down $10k on the new house (from my personal emergency fund). I was able to pay that back in full from the rental proceeds this month which to me is huge.

After I close on this new house, do the 'bulk' of the work I want to do on it I want to re-evaluate jobs and what I want to do. Right now I need to keep this high dollar job for the loan.

I will update on the loan and house situation as it develops

I reached the end of my 5 year plan and need to set NEW goals..and a new plan

Posted in

5 Year Goal Status,

Musings

|

3 Comments »

June 3rd, 2018 at 11:50 pm

Hi there.

Some good and bad news to share.. or potentially bad.. at the very least stressful

good news. I am paying my expenses this month totally from the rentals! (first time).. read below for why

bad/stressful news.

I am not happy w the job.. those who read earlier post know that I specifically took this job dependent on a Winfield or Elk Grove location (nearer to the house) and specifically said I can not and do not want to work downtown... location is not off the train and even if it was I do not live near the train anymore.. I was told that is fine and I would only have to work downtown for 1 week etc etc by the CONTRACT FIRM. I get to the job and the client I am working for appears to not have been told this at all. I work downtown 3 days the first week. then Elk Grove the second week and then we are told we are engaging in team building and everyone has to work downtown for the next 4-6 weeks. I remind the client of what I said and it is suggested I work downtown 1 week (they pay for hotel etc) and then 2 days a week thereafter for the next 2 weeks. I do not like but if there is an end in sight it is fine. Turns out there is no end in sight. I have been working downtown ever since and we are supposed to work downtown for the next SIX weeks and then every other week thereafter. There is no work location in ELk Grove or Winfield. Those are client sites with really no sitting places.. just datacenters. Everyone else is flying in and staying Mon_Thurs so folks are working late, setting team or client dinners after work.

I feel stressed and really this is not what I signed up for at all. It is like a lifestyle change.

On top of that I find out FRIDAY that because I am 1099 I am not paid anything .. ANYTHING... until end of June.. and expenses incurred in May are not paid until June 15.. so I am fronting all these expenses on my card.. and accruing costs like crazy w these hotel stays downtown Chicago.

The 'work' is ok but really nothing i am super skilled at (LOTS of advanced excel work consolidating datacenter inventory lists and I am getting no direction as to what to consolidate.. ie.. what fields).. and the team leader I am assigned to was a program manager and does not know the 'tech work' either so is irritated that I am new and does not know how to teach me what to do.. and they do not want me to ask anyone else (because we are working with 'just our team'.. I HAD been asking other teams for direction just to figure out what to do.).. She has complained to the program manager 3 times about me already

I am still holding out some hope that this can work out and will find out more next week. Program manager says team leader may be taking her frustrations out on me (but wants to 'sit in on some of our meetings anyway') and promises more resources.. crazy.

When I do not work in downtown Chicago I work at home which is nice but would be dramatically better if I was not so stressed from staying downtown for 2 days and had work to do that I feel capable of. I sortof feel set up to fail here.

I said I was open to switching teams.. everyone else has good things to say. how I learn fast etc.. but as of yet the request has been refused..

Very unhappy and scrambling to make bills .. (glad I have the rentals that paid for this month but irritating fronting all these hotel charges.. not to mention parking overnight)

I am passively exploring other opportunities near Naperville and submit 3 resumes today

My main criteria was to have a job I could continue to work out, have a life and go to school. there is no way to I can go to school or do homework w this crazy downtown schedule and working late and being tired and stressed.. if a new job has to pay less than this exorbitant amount I paid (or WILL BE end of June) that is fine.. but I need a life too and less stress.

I will work on sending out those resumes now.

and will try to get more info next week

Why am I not insisting they (contract company or client) honor what they said about not working downtown?? ANSWER- i can see there is no other option and I would rather have a job while I look for one

Rachael

Posted in

Musings

|

5 Comments »

May 5th, 2018 at 02:31 pm

Hi all

Update on the new job.

So far love the work, love the people..do not like location. and feel a little unsettled. If I can get an idea more of what I am doing and WHERE and the # of hours worked I would be much happier.

My final location is not defined yet (only worked 1.5 days last week) and worked downtown...$16 to park and 3.5 hour roundtrip commute. NOT FUN. Project is just starting so a little chaotic.,. new program manager. folks flying in and out. figuring out scope and what is going on (THEY are figuring that out too). When everyone left Thursday noon I was so new there was nothing for me to do so I took off Thursday afternoon and Friday. I expect to get full hours in the future. Total work over 3 days was 13 hours.

They are saying I will work in the suburbs (Elk Grove or Winfield with occasional trips downtown) I will feel better when confirmed.

My peer who I tag teamed with last week is flying in Monday late (vs Monday am) so not sure what I am doing Monday. I have a note out to the program manager to see if I can tag team off someone else for the day at Elk Grove or Winfield. I DO have a few calls to attend (which can be done virtually). One of the choatic things is the program manager is switching too so leadership is a little unclear on some things.

No laptop or ID yet (hopefully next week)..

I am throwing out a bunch of fears here mostly because things are not locked down but really all signs are the location will be suburbs and hours will bump up to full time and maybe as I am the ONLY local resource.. maybe more hours some weeks and maybe since I am local I can take more of a leader role as things go along. I am probably still shaken up by my last job too.

Fingers crossed. Wish it was more locked down but IF the above 2 things work themselves out this job will be FANTASTIC. like it much more than my last 3 week gig. Love working as part of the vendor team onsite and people are great. real high performing team. feel proud to maybe be a part of it

and the money if hours bump up will be fantastic!!

I will set up my solo 401k once the above 2 concerns crystallize and I feel more secure in my role

Rachael

Posted in

Musings

|

1 Comments »

April 27th, 2018 at 01:56 pm

HI all

All signs are this job is a go.. large company.. 1 week downtown Chicago for training and then onsite in WINFIELD (10-15 minutes from the house).. my gym is on the way there and on the way home. It still allows for school. business casual. I am working with a vendor team onsite at their client which is a much more fun model than the one I just left (at the bank) and much more closely aligned with how I used to work at my large long term client . much more pay... $79/hr

Excited. nervous .. WOw

I talked to my accountant and w the tax laws and the rental income and the fact that the contractor firm

does not pay benefits. it makes sense for me to go 1099 vs w2 so I am goign to do that. He even thinks I will save at least $10k a year doing that. AND they don't offer a 401k either so I will set up a solo 401k and contribute the max to that and then the company can pay in 25% of my total comp. If I work there through year end that is over $40k thousand this year to the 401k!

I will research solo 401k companies.. and my accountant may have thoughts.

Losing weight finally!!! and gettign in shape .. feels great..

I gained 9 lbs between July-Dec last year likely due to the 2 flat nightmare but I am toning up and going to lose that

So still hoping to finish my 5 year goal strong (5 year goals ends 6/30/18) and then this entire year strong in terms of saving as much as I can

I am SO EXCITED that maybe I have a high paying fun job that still allows me flexibility to work out, go to school and have a life.

Fingers crossed it goes well.

My start date will be either Wed/Thurs or Friday next week. Still pending drug test and background check (I should have no issues)

Rachael

Posted in

Musings

|

12 Comments »

April 25th, 2018 at 02:48 pm

Hi all

Quick job update here..

First of all I am still struggling.. my mood is going up and down.. I am realizing how much of my self worth or mood is tied up with earning money and having something to do.. good to realize this now. Even though I have money saved I feel 'restricted' and anxious and less happy not having a regular source of income.

For those who are saying 'what about the rentals!!"

I do have rentals but this month is the first month I will be able to track them without loans etc.. (except for the 2 flat) so I do not feel totally secure in them.. actually I am feeling insecure in general and stressed lately.

I DID set up to meet w the property manager tomorrow to discuss things. get clarity. refine some stuff.. but all and all property management is going well

k. JOB STUFF.

I was OFFERED A JOB (already!!??) seems too good to be true as it sortof hits all my criteria..or seems too. I am hesitant as I am anxious about being let down and scared about returning to work and having it 'not work out again'

Job is a contract job (which I want).. pays NINE DOLLARS more than my last job (which ended in 3 weeks) which will make my total increase over my last long term job $19/hr.. $38000 a year increase at 40 hours a week.

Crazy

Work is local.I would be working for a large well known company (#2 on best places to work) for THEIR end client who they are doing a migration for..location is Winfield (10 minutes) or Elk Grove Village (30 minutes)..I find out location next week.. those are the locations of the two datacenters.. business casual and working on a vendor team. The large vendor is flying in 2 full time people each week to be primary. My role is to be part of the local team working w the vendors and help with the discovery and planning process.. working with the application owners, users, tech people etc..

I start with a week of training on the vendors proprietary delivery and migration process AND (wait for it). since the full time people are flying in each week. they are only onsite Mon-Thurs so I get to follow the same schedule and work at home Fridays!!

Initial contract is short.. end of August but that is because they only sign milestone based contracts.. first client milestone is end of August. total project is expect to be a year or more.

The vendor sold this contract without ramping up staff so they need people to start asap. I have already filled out background checks forms and will do my drug test shortly.

Fingers crossed I get the job and fingers crossed it goes past end of August (again recruiter and vendor said it will unless something drastic happens that the client or vendor do not like me or the client cancels the contract.. unlikely)and fingers crossed it is the location they say and the work is what they say.. nervous!!

even if it only goes til August maybe I can get back to my old company then (the work at home one that I worked at for the past 6 years) or somethign else. having this name on my resume will be very good and experience.

I should have start date today or tomorrow.. and something in writing to sign shortly thereafter.

I have an unemployment comp interview in 45 minutes. my application was flagged due to going to school and they could not pull up the 3 week employer payroll in their system. I have proof of both.

Rachael

Posted in

Musings

|

7 Comments »

April 19th, 2018 at 07:05 pm

Update

I got approx $96k from Dad. $26,600 of that in an inheritor IRA.

Today I

1. paid off the 2 flat 'fix up debt', $23,700

2. paid off student loan of $9k

3. put $2000 more in the rental emergency fund

4. put $13500 more in the rental tax fund to 'catch up'

5. set aside $2000 for me (to be determined)

I have $23,500 left in a taxable account just sitting at this point. I will wait to figure out how much of that to invest until I get a clearer idea of my job search

The inheritor IRA will stay. that is invested in the Fidelity Total Stock fund.

Will decide on selling the 2 flat in the next few weeks

Posted in

Musings

|

3 Comments »

April 19th, 2018 at 06:17 pm

HI all

I am tracking my job search goals and progress. I DO NOT want to dip into Dad's money or my savings.

I have $3500 coming Friday. Unemployment is $458 per week..first check unemployment check.. 2 weeks??

I am still clarifying goals and my routine.

For now I want a senior program or project manager in the Western burbs or remote (not going downtown or NW burbs limits opportunities). I am trying to get a rate of $68/hr. less is ok dependent on circumstances. My last job full time remote was $57/hr

I DO not want to sacrifice working out at the gym or school

So far I have updated my Linked in profile, talked to 4 recruiters, sent some resumes, contacted my old company (before this bank fiasco)and filed for unemployment.

I will update my resume on job boards today, and adjust my settings on linked in and others to draw more calls

Really need to figure out my minimum requirements and what I am not willing to take.. ie it appears I would have a good shot at a job making $68/hr downtown.. but that would involve the train (drive to train, train downtown, cost of train, extra time needed to do all that ) not sure of dress code (formal dress? it is more formal downtown,.. have to buy clothes).. flex hours??. I will find out more but preferring suburbs or remote.

I am figuring I can always take a job short term and then when openings come up at my old company (where I worked for the last 6 years .. just switch back to them.. ) there I can work remote and part onsite. Maybe a thought to avoid the $$ drain and to meet people.. All as long as it does not impact school. gym etc

Need to figure stuff out.

talking to a life coach today.

Posted in

Musings

|

1 Comments »

April 17th, 2018 at 02:33 pm

Hi all

I am going to document my job search and my goals during this time here. I think it will be helpful to me and maybe to others to watch and see

Anyway today I am going to figure out what the plan is.. hopefully talk to where I used to work (already left voice mails. sortof discouraging to leave voice mails. it makes me think 'they are busy with productive jobs' and I am unemployed' anyway!!) and get my resume up to date and posted.

probably figure out some goals and $$

and some 'other stuff' to accomplish during this time.. sortof get my life straightened up.

THANKS To all for your SUPER supportive comments. Crazy situation. Could I have maybe done stuff not to have it blow up so bad.. not sure..I guess not call laura out for the untruths and not get upset.

Regardless. was I happy there?.. No.. and the job is gone. would I have been happy there like it was?. not really. I could have grinned and bared it for a while but would it have shown .. probably.. Laura.. This all happened in 3 days.. vague accusations. some of them i was able to disapprove right there.. then sortof significant escalations. a 1:1 reset set up for yesterday and my submitting info on what I had done at work and info on my performance to the hiring manager and then apparently 1:1 cancelled because Laura said thsi was 'unfixable'

Obviously still in defensive mode..

I will get better.. and I want to do everything in my power to not dip into Dad's money or the savings which means working other jobs outside of my field, short term gigs or doing my own consulting on the side. My net cost to live is $5000 NET/month

Will file for unemployment today

I have a check for $3570 coming Friday and then 3 more hours due to me..after that.

Be creative

Rachael

Posted in

Musings

|

4 Comments »

April 16th, 2018 at 06:16 pm

HI all

Got fired this morning. Contract company came to work, called me from downstairs and asked me to come down and advised Carla had told them it was not going to work out. Carla and I had a 1:1 at 1pm.. never happened. Carla told the contract company she talked to the 'program manager' Laura this morning and after that determined it was not fixable and better to let me go sooner vs later.

I was never told what was not fixable. or what my 'performance issues' were. I wonder if Carla will ever review the work i did not or talk to people.I talked to a few people who were shocked.

In any case. REALLY EMBARASSING.. the guard walks me back to my desk, watches me get my stuff and walks me out.. very bad.

I will contact me old company direct tomorrow.. I am too 'scattered/shellshocked' to contact them today.. I will file for unemployment. hope there is not a dispute and look for a job.

on a HIGH note getting out of the house and working at the office (near by) was fun and showed me how much of a social life I was missing and gave me much more energy. I like that and I will not go back from being as socially isolated as I was..

On a low note.. I am out almost $8000 a month.. not a good time for that. I DO NOT want to eat up Dad's $ that I am to receive or the emergency fund and I want to keep building savings etc.

Being 'let go' impacts my confidence a little bit. not sure what to say to the other company. Not sure what the contract company who got me this job thinks. This was my first gig with them.. will they block unemployment. Find me something else??

with my old company do I say I started the new job and there was a personality conflict?? say I never started??? Ideas welcome. I will contact them tomorrow.

Maybe I am due for a change.. maybe that time is now.. everything happens for a reason. I do not want to rely on the rental stuff.

I DO NOT want to work real far from home. I signed up with Lifetime fitness.. and am doing team trainer sessions 3x a week (started today)...I guess I have different priorities right now and want a job that leaves time for them

I feel with this 'reboot' of going back to work even for a little while I can now maintain a social life even with working at home. whereas before I was just sortof not engaged socially.

JUST TIRED

I am just real tired right now.. sortof shocked.. not much more to say

Things change pretty quick, huh? I get some vague accusations of performance issues and them am fired 4 days later.

Posted in

Musings

|

13 Comments »

April 12th, 2018 at 11:22 pm

Hi all..

Crazy week. CRAZY! as most know I started this new job w a large bank etc etc.. project manager.. I used to be a program manager for a financial services company with this bank as the account. Anyway I now work for a program manager and just manage a 'project'. Work is easy and I can do 3-4 times the work in an 8 hour day and still be ok. I have very little to do and though it will pick up it will not be crazy like my last job when I was in charge.

Anyway I have felt tension brewing between me and the program manager (Laura, also a contractor) for the past 2 weeks.. significant micro managing (everything I do has to go thru here, I must cc her on EVERY email, every meeting, put things in email so she can be cced, no phone calls to others).. she setup an alert on 'Skype" (this work instant messenger system) so she gets notified hte instant my status changes from busy to available to away to out or whatever. I can not even use the washroom without an alert going off. I do not have much to do whereas she is 'swamped' but she spends quite a bit of time talking about how swamped she is and storytelling and drama. I have offered to help her with things several times and have been told the tasks she is doing are "program tasks", and she has to do them. I have offered to take on additional work, lead meetings only to be slammed down for overstepping and 'that is not my responsibility or scope'. I put together a schedule and she said it had to be redone on a certain template and to toss it and then I had to meet with the team for 2 hours to 'redo my work' even though the outcome was the same schedule. She is still reviewing thsi schedule weeks after it was done. Everything has to go through her for review and she becomes the bottleneck. She attends meetings and takes them over or cuts in on me. on and on and on. She visibly checks her watch in front of me when I walk in. Two weeks ago when I worked at home... she said 'Skype' showed me as 'away' a few times and that 'contractors have been fired for abusing work at home privileges' I said I was working and maybe I was on the phone and not touching my keyboard at the moment

Anyway it has made me VERY STRESSED and UNHAPPY.It has impacted my speech due to stress. I feel WATCHED all the time.

I have to wear a headset at work to talk on the phone which I HATE and to make it worse I got issued more like headphones which are soundproof and like stereo sound and give me a headache and make me not sure how loud I am. So for that reason I reserve conference rooms to do meetings so I can just use the speaker and so if a teammember wants to come they can do so. More fun.. team building.

Anyway Wednesday I had a 1:1 w the hiring manager who hired me (at the bank) This resource mgr had a 1:1 w this program manager (Laura) right before me and when I come in the hiring manager says we are revoking your work at home due to performance issues. I was shocked and asked what thsi was about. She said I had not turned in my schedule to Laura. I said I absolutely did and I can grab my laptop to show. I insisted (over HEAVY objection) that she call in Laura and Laura comes in and says 'maybe I missed it with all my unread emails" Laura later finds the schedule submitted on time. I then asked Laura if she had issues with my performance 3 times. I asked 3 times and two times she avoided it and then second she is like ' no but let me review the schedule'. Meanwhle the hiring manager is clearly REALLY pissed I put Laura on the spot. she asked Laura to leave and after Laura left the hiring manager said 'you work for me. I am telling you these concerns I am not going to let you drill Laura'. I said the concerns are from Laura (fyi I only see and talk to this hiring manager every 2 weeks for our 1:1 she has no visibility into my work except thru Laura) and I am not understanding what they are and if they are even there. This is appearing unfair and I am not understanding. The hiring manager then says the 'impression' is you are not keeping up and then asked me if I had completed several things.. all of which I had. I said I gave her time to talk and I was requesting the same.I said I ABSOLUTELY deny any performance issues and think I have the right to understand what performance issues are at issue. No response. And then making up stuff like I am not proactive, waiting around to be told what to do, not 'attentive' to work, not visible etc, not ahead of the project (the project has not started as we are waiting on funding which Laura says is a program task and I am not to help with.. everything else is done)

Meeting was very tense so it ended.

I asked if we could speak again after I had time to reflect.

Manager said no and she was going to contact my consultant company and handle it through them.

I had a work at home day set up for kitchen work today and the Manager said I should just take the day off and I would not be allowed to work at home.

I called my consultant firm and updated them.. they thought this was crazy and wondered if Laura was the issue. They had a preplanned lunch w this bank hiring manager today. I will hear tomorrow how that went. The hiring manager at the bank called the consultant company account manager to complain and sent them an email which they sent to me.. all vague crazy accusations.. I mean not even Laura would say these things they have so little bearing on the truth.

Meanwhile Wednesday I asked 4 times for a 1: 1 with Laura. All day Wed Laura avoided it .. then right before I left she came over trying to be all nicey nicey and said 'it was the hiring manager who revoked work at home not her'.

I came in today for 3 hours (at the suggestion of my consultant company) and again Laura avoided meeting w me and was trying to be all smiles.

I will go in for a full day tomorrow and again try to meet w Laura.

My guess is that Laura did not mean for it to blow up like this and the resource mgr ran with it and I probably got the hiring manager's hackles up with insisting on confronting Laura in front of her to see if it was really true that Laura said there were performance issue(which it sortof appeared there were not or Laura was not willing to admit it??). I DO think Laura must have said something though.

Anyway .. I will ask Laura if she has performance issues and then talk to the resource manager or have Laura do so to rectify this. It really bothers me to have my reputation sullied and this tension.

At this point I have been labeled w false performance issues and denied work at home and am being watched (though that was an issue before)

REALLY bad at work. and I am very angry

My consultant company believes in me and says if not resolved in the next few days they can try to find me something at this bank or somewhere else

I have made inquiries at my old company. I feel my job is at risk

two flat 1st floor rented!

Posted in

Musings

|

17 Comments »

|