|

|

|

|

Home > Category: Net Worth

|

|

Viewing the 'Net Worth' Category

December 24th, 2020 at 03:24 pm

Hi all

Writing to keep myself accountable.

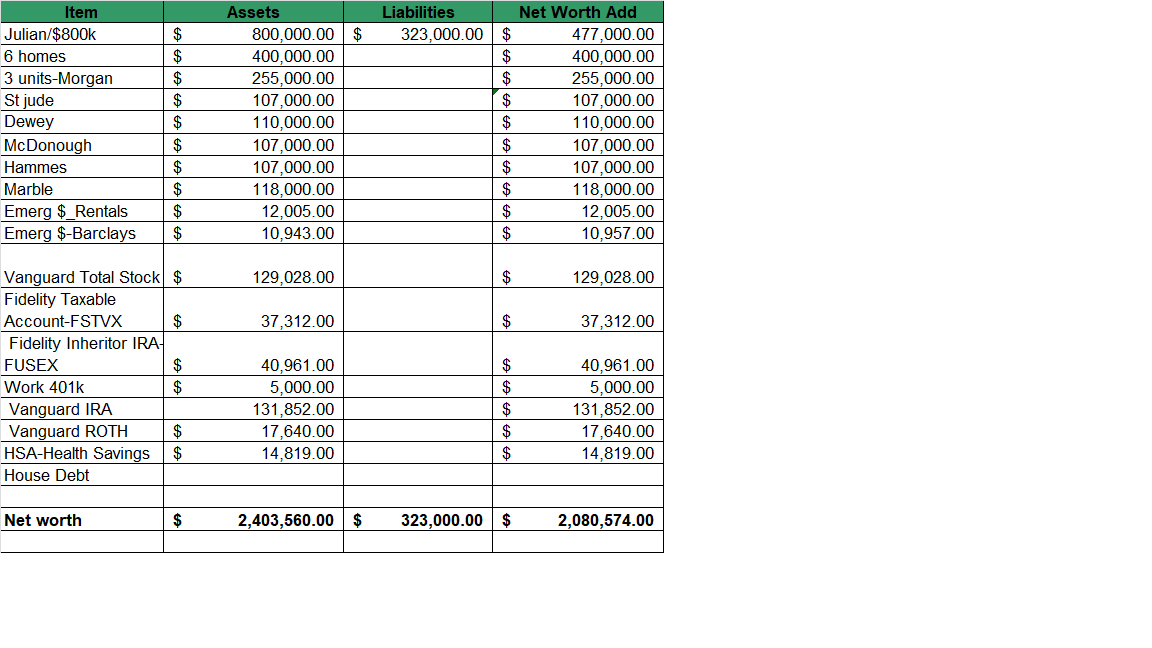

Current net worth for year attached

Next years goals

1. 500k total investments between taxable and tax deferred

2. fully fund IRAs for 2020/2021

3. Contribute max to regular or solo 401k (dependent on job)

3. Practice financial freedom. Fully live off rentals from Feb 2021. All earned monies go towards savings, giving or fun.

Towards this end I am looking at decreasing monthly costs first

1. health insurance is $540/mth (ouch, I am looking at how I can reduce this by $200, hopefully news next week)

2. cut costs of supplements $240 a year

3. cut lawn care costs by $200 a year

4. will cut HSA fees by 100 a year (did not know it was that high) by moving it to Fidelity

5. will cut monthly chiro membership, will save over $600/yr

6. will look into reducing cable boxes and using Roku and Infinity add on to still get Comcast on those TVs for free (potential savings, $180 year)

7. will look at eating out costs

* I increase my auto investments amount by the amount of the cut once it is made and official

and then rental income

1. will look at rental variable costs (utilities, taxes, and maintenance). see if we can do better

2. will look at vacancy rates, see if we can do better

and my income

1. line up a contract for after January (preferably 1099 for tax advantages)

2. look into other income sources to switch too or just to have. (ideas wholesaling real estate, blog, consulting or selling something in my own business)

and not losing track of the big picture

1. Make an impact on people. Share my faith and blessings with others.

2. Make a bucket list of items I want to buy or do or help people with and work my way through it.

PS For those who are struggling or get discouraged. I just looked back at my first entry, October 2013, I had just bought the first 6 homes and was recovering from basically losing everything. It really is very emotional to read this and think back. I was so full of excitement, fear and hope back then and so naive but I hung in there and I MADE IT. You can too.

This was a quote from my very first post

" I am concentrating on real estate as my avenue to freedom.. looking at 'monthly income' vs savings. I want to have enough monthly income in 5 years (see my goals) to feel 'safe' and like I have choices. I am in good shape and health so do not feel I will quit working but will certainly enjoy any job I do more knowing I do not 'have to' work. "

Posted in

Net worth,

Musings

|

5 Comments »

January 10th, 2018 at 07:55 pm

Hi all

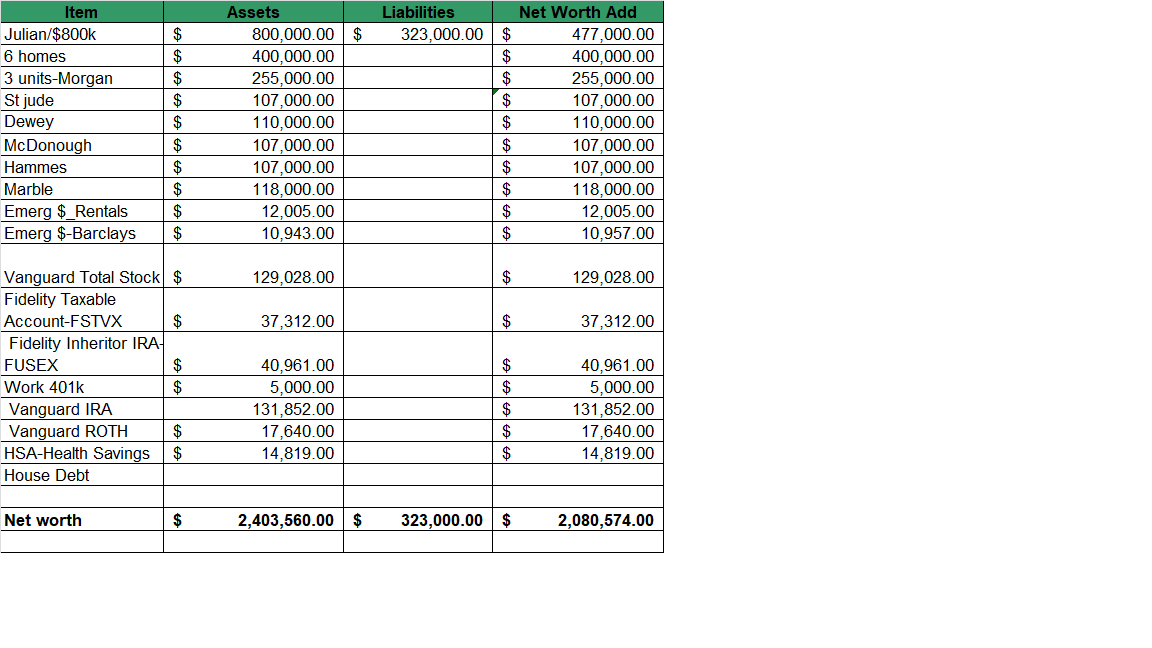

Networth attached from the end of last year and I met all goals except increasing my investments to $380k. I was almost $43k short. That was due to the excessive money put into the 2 flat. I want to have at least 50% of my networth be savings and investments. Right now i am at 22%

I also started school last year. Masters in Ministry leadership.

2 flat carpet and appliances go in today. so on the home stretch!

I will set new goals next shortly. Rentals are definitely stabilizing but w the income from those and this job I need to take some steps to save taxes. I am talking to my accountant on that.

FINANCIAL GOALS FOR End of Year 2018

1. $425k in Total Investments

2. Rental emergency fund $18k+

3. Personal emergency fund $15k+

4. Payoff 3 units

5. $20k left on 2 units or SOLD

Posted in

5 Year Goal Status,

Net worth,

Musings

|

6 Comments »

January 12th, 2017 at 06:31 pm

Hi all

Year end goal updates and networth at year end below

VERY busy at work but did get renewed thru 6/30 and woudl think they will renew me again after that. VERY BUSY.. Working lots of hours which of course means more $ as I am paid per hour. I am still on match.com but it is expiring 1/16 and will take a break for now. I am dating some guys. two of them. not sure if they are a match but figuring that out as we go along.. but need a break

I DID close my rescue.. bittersweet..emotional. sad.. but DRAMATIC change in stress level.. loss of $30k income on top of $1750 month loss when my ex moved out. VERY TIGHT year for 2017 and need to find additional ways to make more money to meet savings goals.

2017 is the last full year of the real estate payoff. real estate will be paid off in full 6/2018

Currently dealing with 2 vacancies and 1 unexpected turnover. Upsetting and expensive. I am not as 'on it' as normal with work stuff and also hurt my knee badly

I am dropping HSA funding this year and will not do a ROTH or regular IRA this year. Does not make sense to do so. Doing just investments and fully funding 401k and beefing up emergency funds (for rentals)

Anyway will post new goals shortly. just saying HI.. miss you guys and talk to you soon.  ..rachael ..rachael

GOALS FOR End of Year 2016 RESULTS

1. Maintain emergency funds at correct levels-DONE

2. Increase total savings and investments to $310k-$41k short, only had $270+

3. Increase rents across all units by $600-increased $305

5. Raise rent or sell 411 house-DONE, + $50

6. Buy 2 more homes-bought 2 flat and 2 homes

7. Fully fund HSA accounts-DONE

8. Fully fund 401k account-DONE

Posted in

5 Year Goal Status,

Net worth,

Musings

|

4 Comments »

December 30th, 2015 at 04:18 pm

Hi all

New 2016 goals below and on the left. I have NO pending large repairs across the rentals. what a change. the first two years were ongoing repairs and fix ups.. no such pressure now.. of course still maintenance and I do WANT to do some long term things but they are not required..

Still setting personal goals.. looking forward to another busy wild and crazy with ups and downs year.

Need to reduce my stress, the amount of stuff I have going on and do more for ME

GOALS FOR End of Year 2016

1. Maintain emergency funds at correct levels

2. $310k total savings and investments

3. Increase rents across all units by a total of $600 month by year end

5. Fix up/raise rent or sell 411 house

6. Buy 2 more homes

7. Fully fund Roth/HSA accounts

8. Fully fund 401k account

I will try to fund the HSA and Roth by February then all the rest goes towards taxable savings.. I will try some of the methods folks are using on here to track #s etc. I do VERY little tracking of personal. adn want to do more.

If the 3 units were paid off and I was not accelerating payments on them so much (I pay over $5k for the mortgage right now) I am at about $7k net cash flow/month with a 5% vacancy rate and other escrows included (tax, repair, insurance etc).. I am still smoothing things out so NOT at that right now.. but these 2 months w the new property manager have been the best in terms of stress and money in a looonng time.. I will check my vacancy rate these past 2 years .. and then again this year and onward. I have the feeling I will have less vacancy adn faster tenant placement w these guys..

really excited to compare this years #s to last years and have some more baselines. I did have a handy dandy excel sheet for that (which I still do) but lack of management reports and accountings from the old manager for 6 months makes it more challenging..

Posted in

5 Year Goal Status,

6 homes-rentals,

3 units-rentals,

Net worth,

Musings

|

1 Comments »

December 29th, 2015 at 06:36 pm

Hi all

Year End Wrap up #s

LOTS of savings!! the hard work paid off. I saved $53012 OUTSIDE of my 401k. went to taxable investments, ROTH or HSA

Also got $200k from family.. used it to pay off 6 homes and put almost $80k towards investments

GOAL RESULTS and Networth chart attached

I will set 2016 goals tomorrow..and work on rental year end #s

Also want to track my personal costs like others are doing..

RESULTS FOR End of Year 2015

1. $15k rental EF=-DONE

2. $35k increase in savings/investments-DONE

3. 1 Roof for 6 homes-DONE

4. Decrease negative cash flow on rentals by $400/mth-$356 INCREASE

5. Stay within maintenance and vacancy budget for all rentals-OVER BUDGET

6. Make all 6 homes/3 units payments-DONE

7. Fully fund Roth account-DONE

Posted in

5 Year Goal Status,

Net worth,

Musings

|

4 Comments »

May 28th, 2015 at 09:59 pm

Hi all

Networth and mid year check

Met these goals

1. fund ROTH

2. save/investment increase at least $35k (still saving!)

3. 1 roof for 6 homes

also SOLD Tahoe and paid off Genesis

Still trying for these goals

1. make all 6 homes/3 units payment, keep rental emergency fund at $15k, raise rents by $400/month and stay within maintenance/vacancy budget

Picture is net worth.

I feel better and better w this 6 homes inspection. It will allow me to accurately forecast any other major repairs needed.

News on that when I get it set up.

Posted in

Net worth,

Musings

|

4 Comments »

December 23rd, 2014 at 10:14 pm

hi all

This is the first of probably a few posts as I go through the numbers

General results this year

1. $40,207 total savings (went to Roth, rentals, emergency fund and investment savings) .. still .. wow.. lot to save!

2. $249,882 increase in networth off of last year-mostly from primary home ownership and rentals

3. only $1099 OVER yearly budget for rentals for maintenance/repair and vacancy budget. BUT did lots of long term repair items this year.

4. $31,595 in long term improvement to rentals-includes 2 new roofs, fixing 2 roofs, water fix at that one house, and updating 2 homes and updating 2 3 units

5. $220 DECREASE in negative cash flow over last year on the rentals

6. ABOVE decrease is primarily in 6 homes. 3 units had INCREASED negative cash flow to budget

Will study some more and list accomplishments. trying to diary the journey. this was a big year..

Set some new financial goals to the left

I get my next free and clear house 2/2016

My main goals continue to be to smooth out the rentals, keep my job and have enough cash reserves. there is no leeway in 6 homes/3 units payments and the deal was signed assuming I would NOT have a primary mortgage payment until 2016 or later. That is why things are so much tighter than expected.

Need to rebuild rental emergency fund to $15k asap and considering increasing the personal (lose my job) fund to 4 months which would be $14780. 5 months is $18475

Need to sell this Tahoe

Rescue interested in the cage bank has not been in touch lately and I am thinking they are struggling to get the funds. I put in a call today.

Posted in

5 Year Goal Status,

6 homes-rentals,

3 units-rentals,

Net worth,

Musings,

General rental updates

|

4 Comments »

June 19th, 2014 at 01:18 pm

HI all,

Thought I would post a quick networth here... it is fun to look back and see the progress.. October 1 marks 1 year on SA.. wil recap progress then.. 6 homes and 3 units are not in my name yet. they are on a contract for deed but still listed here. Values are the price I paid. I did a lot of figuring yesterday and basically things look positive for the 5 year goal. ..I am not on target to reach it but on target I think for 'year 1'..where I am short is this: pay off the house goal (no plans yet but still stabilizing) and $300k cash (only projecting as of now $170k need to increase this) and 3 units and 6 homes will likely only give me $6000/month. and 3 units will likely not payoff til 5/2019... I have a little under 4 years m more to meet my stated goals so I think off to a good start. but SUPER IMPORTANT I stabilize and have lots of extra cash on hand for emergency. I will be 47 6/2018.. birthday is October.

Trying to stabilize here and get on a routine..

Settled 2 flat yesterday.. lots of drama.. tenants were upset and threatening to sue me... not sure for what. I advised them about the foreclosure months ago..and set them up w a lower rent.. lots of landlords just walk off. I maintained the place to the end and returned security deposit. Anyway hopefully that chapter is closed. They will rent from bank and then new owner now.

Hope to hear on refinance Monday.

JOb interview tomorrow and one next week. all for large companies. one contract at $65/hr. one is salary .. likedly $120-130k.. unsure.

I wish I had word on a job nearer . I am concerned I am going to get offers next week and still not have heard or gotten any leads on local jobs. so far I have been submitted for 4 local jobs.. have no word at all on 3 yet and did an interview on one and got beaten out.

The contract job at $65/hr (likely at least 2 years) appears NOT to offer 401k for the first year.. crazy. I will ask for that exception if I get it. I work at home today and will try to incorporate some job search. I used to just wait for a job to end before looking for another. I will be more vigilant now. it is VERY NICE to have the luxury of looking for a job while working one so i have minimal downtime and I need that.

Marching forward. settling a lot of stuff this next 3 months then things smooth out.. (wiping my brow)

I did open a taxable investment account at Vanguard I am really liking Vanguard. put $1300 in it. I will merge Sharebuilder into that. less fees.

Posted in

5 Year Goal Status,

Net worth,

Musings

|

2 Comments »

February 1st, 2014 at 05:43 pm

Net worth update

House added a lot of equity

house value at lowest of realtor sales estimate - commission

everything else at purchase price

Goal this month..stabilize.. rebudget.. count my money and adjust my plan. I need more CASH LIQUID savings

Upped 401k to 10%.. if I change it to 12% I will max out at $17500 w the employer contribution.

Goal to get emergency funds at max.. I am approx $12k short across both.

Also want to find money for hardwood floors in this house.. got a friend who can help install but got several thousand in materials.. (not figured that out yet) and I feel since the house is now mine.. I want to 'fix improve' several things. most small. some larger.. but just excited. I will make a list and prioritize. i want to enjoy my 'new house'.. got to save money for the yard.. I need some help this year.. getting it in maintainable shape and l ooking nice.. how exciting!!

MOre updates/questions later as I figure things out.

SNOW DAY TODAY

Posted in

Net worth

|

4 Comments »

January 3rd, 2014 at 09:32 pm

Almost hit $150k.. onward to next year.. goal is to have networth of $275k by end of 2014.

Bank accepted offer on house at $297,500 . now need to get the money.. off to a slow start.. need money by 1/31/14

Making calls Monday and have one 'possibility;' in the works. once i have the house worked out I can work on how I am going to reach $275k by next year. It requires almost $80k cash saving or investment earnings.

I am off (will feel better I hope next week w news on loans for the house.

Networth attached.

Posted in

Net worth

|

2 Comments »

December 18th, 2013 at 09:28 pm

Hi all,

Here are my goals. I know I do not have year end numbers yet. but an anticipating ending 2013 around $145k

Networth Goal for 12/2014- $275,000. This is $135,000 MORE than where I expect to end up this year

$135k is comprised of:

$72,031 debt reduction in homes/3 units w normal payments

$24,000 additional misc savings

$8,800 additional 401k

$3,000 additional ROTH IRA

$27,169 (unknown sources)

Unknowns or mitigating factors

1. unknown if my house will work out or not (buy it from bank)**HUGE UNKNOWN**.. effects everything!

2. current work contract only goes through 6/14

OTHER MISC GOALS

1. fully fund my emergency account by 6/14-$16,000 total

2. $7,500 worth of improvements (vs repairs) to 6 homes

Posted in

Net worth

|

0 Comments »

November 29th, 2013 at 04:41 pm

Net worth update.

Still tryiing to stabilize.. hoping to hear from bank next week on if they accepted my offer of $260,000 for the house and then I need to get the money. Once I stabilize w the house my goal is going to be saving and investing as much as I can.. kick my advisoring part time work into high gear. I am VERY light on retirement savings and this morning kicking myself major big time because of it but still proud I am back in the game (restarted 401k, roth this year) and other savings but really where would I have been had I not done that (wiht encouragement from this group). Was I am in la la land or what. Seeing that networthiq website really motivated me (and made me feel sortof bad) .. LOTS of people with $500k= in retirement accounts. I figured it out last night.

At 20%, $500k turns into over a million in 5 years.. but starting with $10ok (no contributions) i t takes 15 .

"this too shall pass"

PRAYING to stabilize and figure out this house thing or not.. very stressful to not know.

Networth attached. No big change which I guess is 'good' becaause I spent $12k + in extras and still managed to stay almost even but need more LIQUID cash!!

Posted in

Net worth

|

2 Comments »

November 27th, 2013 at 02:12 pm

Hi guys.

Thanks to a tip by 'Jenn' (and check out her blog.. very neat stuff). I went to networth.iq and WOW.. what a wealth of information. advice and tips.

I suggest you look at it your self.. you can see others networth by age, income, all sorts of stuff .. see 'where' their net worth is.. VERY INTERESTING STUFF

What popped out at me (Miss making real estate income my main goal) is that I was more impressed w folks who had the bulk of their networth in saviings and investments vs equity in homes or rentals. I feel the same way even though my net worth is lopsided that way right now.

What was motivating was some people who had $375k net worth (again these were primarily stock/investment/retirement plan based networth folks) kicked it up to OVER a million in 5-6 years..so the time frame does not have to be long.. just keep learning and chipping away

After this house (my own) settles in some way I will focus primarily on stock based investing. already have a strategy.. so building up ROTH/IRA and general cash and investments is the goal once the house settles in some way.. either I buy or whatever... still $12k short on my emergency fund but feeling in general good today. Need to kick my side job into gear hear at some point.

This forum has HELPED SO MUCH keep me accountable and moving forward. Hope it has helped you guys as much as me. I have increased my savings, cut costs, started 401k, and roth just this year (after the 'downfall'.. haha)

About to save $1600/year on insurance costs among the 6 homes, 3 units by switching to Allstate. WOW!

I feel I am on the UP hill swing again.

Have a good day guys.. keep saving.. whittling away debt but invest too..

Posted in

Net worth,

Musings

|

3 Comments »

October 31st, 2013 at 06:52 pm

Hi guys

Networth update.. $132,611. I am 43 and trying to rebuild as fast as I can..

I buy the 2 3-units TOMMORROW!! scary/exciting stuff

If my plan works (got almost 5 years to go) I will have $5500 cash flow from the rentals in 5 years..

No word on my own house (the short refinance. I need to clarify that ASAP).

Paid off the warranty this month. Still paying extra on the car but want to get that paid down ASAP.

Fully funded 6 homes large expense fund and moved to interest bearing account

$4000 total in emergency fund (need $15,000)

Cut auto insurance (yesterday) by $480 a year

Re quoting 6 homes and then the 3 units to see if I can lower them.

If hte house works out (where I live) I will get $400 offset on the policy cost because of multi line

Here we go

Posted in

5 Year Goal Status,

Net worth

|

0 Comments »

October 22nd, 2013 at 05:25 pm

Hi all. I feel so much better reading these blogs and hearing from REAL people with real ideas, answer and situations. Need to blog/read regularly.

Ok here. is mine.

Attorney called.. 3 units close 11/1. Scary. These I am taking on a 7 year term and will try to pay off in 5 (*will need a $69k 10/2018 payment to do so)... otherwise will keep on the 7 year term,

Whole plan calls to sacrifice now.. have income later.. (goal is to create $8k monthly rental income by the end of 2018) so these will NOT add any income now. My plan is scary to me but I have worked with people and made it as safe as I can.. These are the last homes I will take on an extremely short amortization. Anything else will produce cash flow now.. but will let these settle for a while and get under control before taking anything else on. I am retaining the existing property manager so any hiccups should be 'less'.

Did my networth and here it is... I used to have $125k in a 401k so feeling a little bad but feels GREAT to start and do it right/safer this time. I want to build up my cash so my networth is more cash or accounts vs real estate and will gradually trend towards that.

Value in 6 homes $52,802.51

Value in 3 units $5,000.00

Savings $83,160.15

Emergency Savings $4,000.00 (added $2k more!)

401k-3% $135.31 (started as of 10/15)

401k-my own

Net worth $145,097.97

Posted in

3 units-rentals,

Net worth

|

9 Comments »

|